What is Bitcoin Mining? Understanding the Mining System and the Costs You Need to Know

What is Bitcoin Mining? Understanding the Mining System and the Costs You Need to Know

Bitcoin mining is the process of creating new coins and verifying transactions on the blockchain. Let’s understand the principles and how mining works.

What is Bitcoin mining?

Bitcoin mining, or Bitcoin Mining, is the process of creating new Bitcoin coins and verifying the validity of transactions occurring on the Bitcoin network by using computer processing power to solve complex mathematical equations. This ensures that transaction data is added to the blockchain securely and transparently.

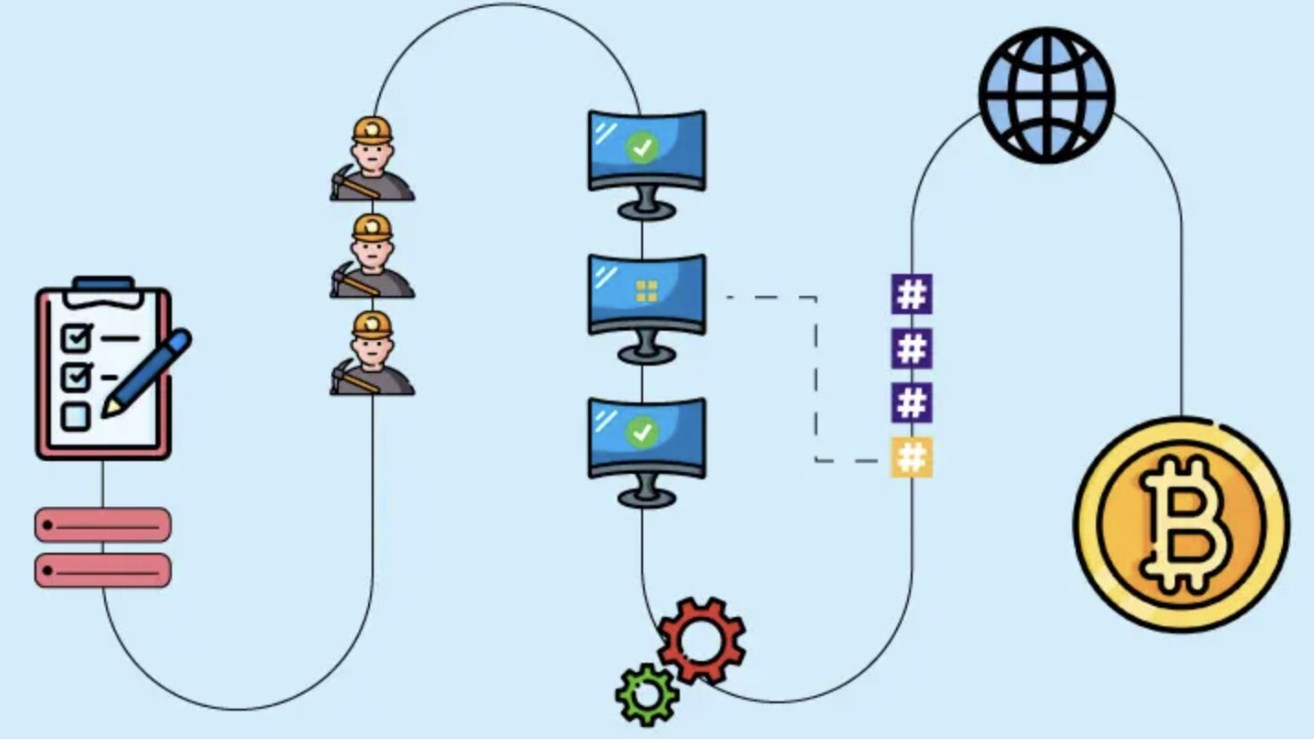

The next question is: How does Bitcoin mining work?

The key principle of Bitcoin mining is the Proof of Work (PoW) mechanism, which requires miners to compete in solving mathematical problems to find the correct answer. When a mining machine successfully solves the puzzle, the system records the new transactions onto the blockchain, and that miner receives a reward in newly created Bitcoin along with transaction fees.

Bitcoin mining works by having miners around the world use high-performance computers (Mining Rigs) to work together to validate transactions on the network. Each time a new block of transactions is added to the blockchain, the system adjusts the difficulty level of the equation so that the average block creation time stays around 10 minutes per block.

So, what is Bitcoin mining in summary?

Bitcoin mining is the process that keeps the Bitcoin network operating securely, transparently, and without a central authority. Miners play a role in both verifying transactions and producing new coins into the system.

Check the real-time Bitcoin price today and get the latest updates on Bitcoin.

How Bitcoin Mining Work

The Bitcoin mining process operates under a system called **Proof of Work (PoW)**, which is a crucial mechanism that maintains the security and reliability of the entire Bitcoin network.

The principle of PoW is that miners compete to solve complex mathematical equations in order to earn the right to add a new block of transactions to the blockchain.

Before Bitcoin transactions are permanently recorded on the network, the transaction data is sent to the **Mempool**, which acts as a waiting area for validation. Miners then gather these transactions and compile them into a block to enter the processing stage, known as **Block Validation**.

Image courtesy of dailycoin

In this process, mining machines must use a large amount of computing power to find a value called a nonce. If any miner is the first to find the correct nonce, the system considers the block as verified and officially adds the data to the blockchain. After that, when the new block is successfully added, the miner who validated it receives a mining reward, which consists of two parts: newly created Bitcoin (BTC) and the transaction fees from all transactions within that block.

The Proof of Work system also automatically adjusts mining difficulty every 2,016 blocks, or roughly every two weeks, to keep the average block creation time around 10 minutes—an equilibrium that allows the Bitcoin network to operate continuously and securely.

What is a Bitcoin Mining Machine?

A Bitcoin mining machine is a device used to process and solve mathematical equations within the Proof of Work (PoW) system to verify transactions and create new Bitcoin coins in the network. Mining machines are considered the core of Bitcoin mining because the higher the computing power, the higher the chance of successfully mining a block.

Currently, Bitcoin mining machines come in several forms, depending on technology and the level of investment by the user. They can be divided into three main types:

1. CPU / GPU Mining

Image courtesy of softwareg

In the early days of the Bitcoin network, mining could be done using a CPU (Central Processing Unit) or the computer’s standard processor. Later, mining evolved to use a GPU (Graphics Processing Unit) or graphics card, which has higher processing power and can solve equations more quickly.

However, as the number of miners increased and the system difficulty rose, mining with a CPU or GPU is now hardly worthwhile because it consumes a lot of electricity but yields very little return.

2. ASIC Mining

Image courtesy of bitbo.io

ASIC (Application-Specific Integrated Circuit) is a mining machine designed specifically for Bitcoin mining only. Unlike general-purpose computers, it is built to process Bitcoin’s SHA-256 algorithm exclusively.

ASIC machines have a very high mining power (Hash Rate) compared to GPUs and consume less energy, making them the primary choice for professional miners or large-scale mining farms. However, ASIC machines are relatively expensive and require a good cooling system to prevent heat buildup from continuous operation.

3. Cloud Mining

For those who want to start mining Bitcoin but do not want to invest in actual mining machines or find it inconvenient to manage the equipment themselves, there is currently a service called Cloud Mining, which allows users to rent mining capacity online. The service provider takes care of the mining machines and all maintenance.

Renters receive rewards proportionate to the Hash Power they purchased, without having to bear electricity costs or manage the equipment themselves. However, it is important to choose a reputable Cloud Mining provider, as there are risks of scams or non-transparent contracts.

Comparison table of cost–efficiency for each type

Type of Mining Machine |

Mining Speed (Hash Rate) |

Initial Cost |

Suitable For |

CPU / GPU Mining |

Low (suitable for testing or learning only) |

Low–Medium (use existing computer or invest in a GPU) |

Beginners who want to learn basic mining |

ASIC Mining |

Very high (highest performance on the market) |

High (starting from tens of thousands to hundreds of thousands THB per machine) |

Professional miners or those serious about running a mining farm |

Cloud Mining |

Medium – depends on rented mining power |

Medium (pay monthly or yearly rental fee) |

Beginners who want to start mining without managing machines themselves |

From the table, it can be seen that each type of Bitcoin mining machine has its own advantages and limitations. Choosing the right equipment should take into account budget, technical readiness, and mining goals.

If the goal is simply to learn the basics, mining with a regular computer may be sufficient. However, for long-term returns, ASIC mining machines offer better performance and value.

For those who want to start without managing the equipment themselves, Cloud Mining is the most convenient and accessible option for beginners today.

Costs and profits of Bitcoin mining

Before starting Bitcoin mining, the most important thing is to understand the real costs and returns. It is essential to carefully calculate energy consumption, equipment, and other hidden expenses.

-

Electricity Cost

Electricity is the main cost of Bitcoin mining because mining machines must operate 24/7 to process transactions. Power consumption is therefore very high, especially for high-powered ASIC miners.

For example, a single ASIC machine may consume an average of 1,200–3,000 watts per hour. Calculating electricity in Thailand at roughly 4–5 THB per unit, running the machine continuously for a month could cost several thousand baht per machine. Therefore, locations or countries with lower electricity costs have a significant advantage in Bitcoin mining.

-

Hardware Costs

The initial cost of mining machines depends on the type and model. ASIC miners, which are the current standard, range from tens of thousands to hundreds of thousands of baht per machine. Newer models with higher Hash Rates are even more expensive.

Additionally, miners must consider accessories such as power transformers, internet connections, control units, and safe electrical systems. These are additional costs that are often overlooked at the start

-

Maintenance and Cooling Systems

Bitcoin mining requires continuous operation, which generates high heat and demands efficient cooling. Without proper management, machines may overheat, causing damage or reduced mining efficiency. Miners should invest in fans or air conditioning and regularly check equipment to extend its lifespan. All of these are costs that should be calculated from the beginning.

-

Calculating ROI (Return on Investment)

ROI measures when the invested money will be recovered. Bitcoin mining often has an ROI period of several months to years, depending on Bitcoin market prices, mining difficulty, electricity costs, and mining machine performance.

The basic ROI formula is:

ROI = (Mining Revenue – Total Costs) ÷ Total Costs × 100%

If ROI is positive, mining is profitable. If negative, it is not yet profitable, or it will take more time to recover the investment.

-

Profit Calculation Tools (Bitcoin Mining Calculator

There are many online tools available that make it easy to calculate mining profitability, such as the Bitcoin Mining Calculator. By entering basic information like electricity cost, machine Hash Rate, and current Bitcoin price, the system calculates estimated revenue and ROI immediately.

Using these tools helps miners clearly evaluate whether their investment is worthwhile before starting.

Factors Affecting the Cost-Effectiveness of Bitcoin Mining

Bitcoin mining requires investment in both time and money. Therefore, analyzing the factors that affect profitability is crucial. Before starting an investment or scaling up mining, miners should understand the following key factors:

-

Current Bitcoin Price: The market price of Bitcoin directly affects miners’ revenue. The higher the price, the greater the mining income and transaction fees. Conversely, if the price drops, mining may not be profitable because electricity and hardware costs exceed returns.

-

Electricity and Maintenance Costs: Electricity and maintenance costs are the main expenses miners face. High Hash Rate machines consume more electricity. Failing to carefully calculate these costs will reduce ROI.

-

Mining Difficulty: This is the difficulty level of solving equations in the Proof of Work system. The Bitcoin network adjusts difficulty every 2,016 blocks. If many miners participate, difficulty increases, causing each block to require more computing power and electricity.

-

Block Reward: Bitcoin miners receive rewards in Bitcoin for each successfully mined block. Currently, the block reward is 6.25 BTC.

-

Halving (reward cut in half every 4 years): Halving is a key mechanism that limits the total supply of Bitcoin. Approximately every four years, mining rewards are cut in half, requiring miners to spend more time to break even and potentially reducing profitability shortly after halving.

Profitability in Bitcoin mining depends on multiple interrelated factors. Investors should continuously monitor and analyze these factors to plan mining operations and accurately forecast returns.

How to Mine Bitcoin Profitably

Although Bitcoin mining can be highly rewarding, poor planning can make it unprofitable. For beginners and small investors, the key principles to increase efficiency and reduce mining risk are as follows:

Choose a mining machine suitable for your budget and space

Selecting the right mining machine is the most important step as it directly affects mining efficiency and costs. Beginners should assess their budget and available space first.

-

Budget: If the budget is limited, entry-level ASICs or GPU mining may be suitable because they require less energy and initial investment.

-

Placement space: For limited space, choose a compact mining machine with an efficient cooling system.

-

Mining Power (Hash Rate): Consider the Hash Rate to match costs and target figures so that expenses do not exceed profits.

Set up a stable cooling and power system

Image courtesy of bitcoinaddict.org

Mining machines must operate continuously 24 hours, so having a proper cooling and power system is crucial.

-

Cooling System: ASIC or GPU machines generate high heat when operating at full capacity. Without good ventilation, machines may be damaged or experience reduced efficiency.

-

Power System: Use cables and plugs that support high energy loads, and consider installing a UPS or surge protector to reduce the risk of power outages or surges.

-

Maintenance: Regularly maintain mining machines, such as cleaning fans and checking temperatures, to ensure continuous operation and reduce repair costs.

Investing in a good cooling and power system helps prevent long-term problems and increases income stability.

Join a Mining Pool to Reduce Income Volatility

Solo mining Bitcoin may yield rewards only occasionally, resulting in inconsistent and highly uncertain income.

To solve this, many miners choose to join a Mining Pool, which combines the mining power of multiple miners to increase the chances of solving the correct hash equation. Rewards from mined blocks are distributed proportionally to each miner’s contribution, making income more consistent.

Joining a Mining Pool helps beginners start mining Bitcoin without relying on luck and reduces the risk of reward volatility. However, when choosing a Mining Pool, important factors such as reliability, fees, and payout efficiency should be considered to maximize profitability and ensure safe mining.

Continuously monitor the BTC price and Difficulty values.

Image courtesy of coindesk

Monitoring the Bitcoin market price and Mining Difficulty is important for miners because it allows them to adjust mining plans according to the current situation.

The price of BTC directly affects mining revenue. If Bitcoin prices are high, mining profits increase accordingly. Conversely, if prices drop, mining may not be profitable.

At the same time, Mining Difficulty, which is the difficulty level of solving Proof of Work equations, is adjusted every two weeks to maintain an average block creation time of 10 minutes. If Difficulty is high, each block requires more energy, potentially increasing electricity costs. Tracking both factors helps miners adjust mining power, reduce electricity usage, or consider pausing mining during unprofitable periods, enabling Bitcoin mining to generate long-term profits.

Advantages of Bitcoin Mining

-

Earn direct income in BTC: Miners receive rewards in Bitcoin when successfully validating transaction blocks.

-

Support blockchain security: Mining plays a key role in validating transactions and blocks, making the network more reliable and reducing the risk of data tampering.

-

Potential for increased profit when BTC price rises: Mining rewards are in Bitcoin, so the value of earned coins increases with market price, enhancing investment returns.

Disadvantages and Risks of Bitcoin Mining

-

High initial cost: Purchasing mining machines and accessories is expensive, ranging from tens of thousands to hundreds of thousands THB, which can be burdensome for small investors.

-

Electricity and maintenance costs: Mining machines operate 24/7, making electricity a major cost. Additionally, there are expenses for maintenance and cooling systems.

-

Risk of loss if market prices drop: Mining revenue depends on Bitcoin’s market price; if it falls, mining may not cover costs.

-

Increasing mining difficulty: The Bitcoin network adjusts mining difficulty every two weeks, requiring more computing power per block and increasing electricity costs.

-

Risk of overheating and equipment damage: Machines operating at full capacity generate high heat; insufficient cooling can damage equipment or reduce performance.

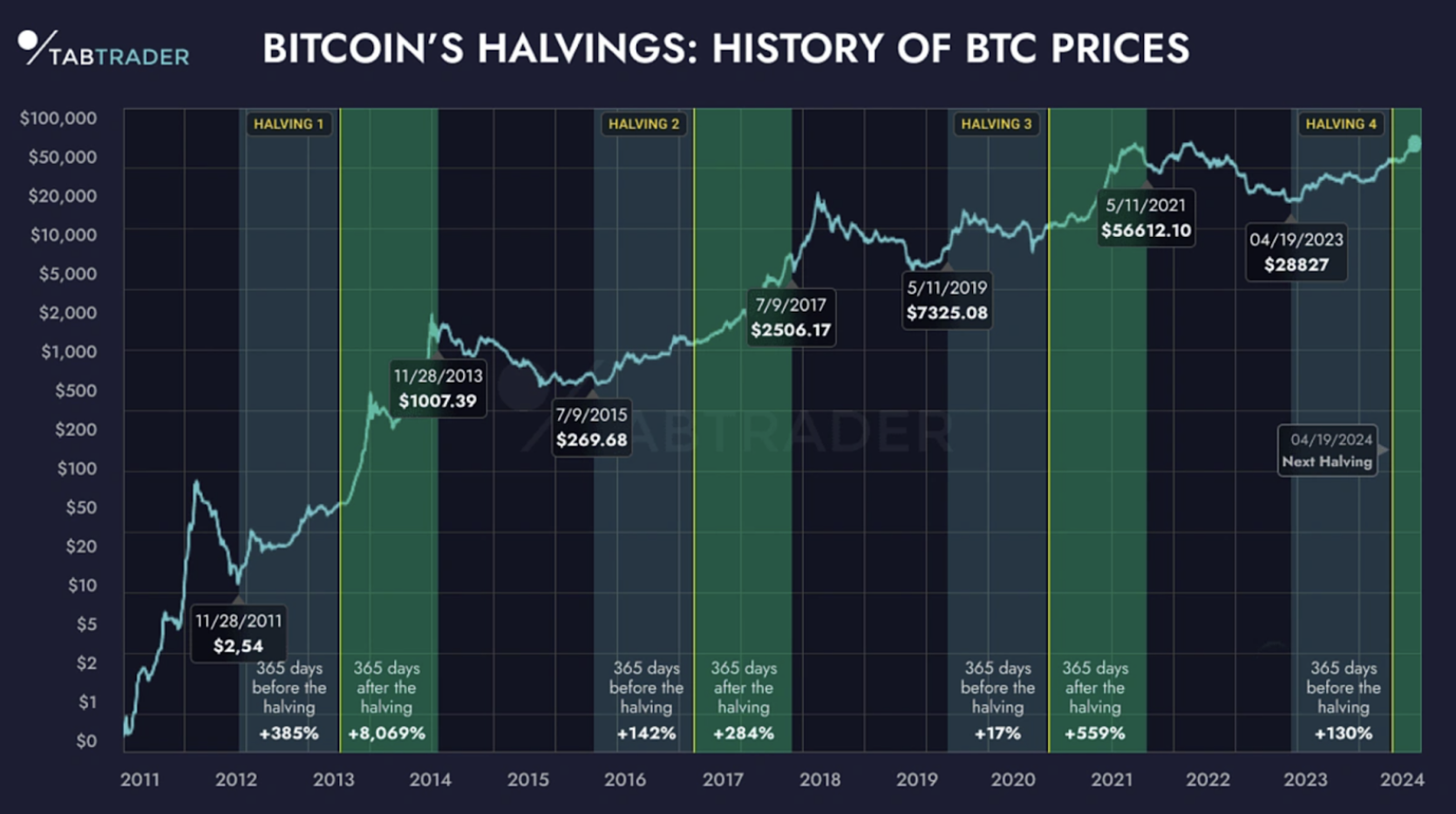

What is Bitcoin Halving and how does it affect miners?

Image courtesy of vnx

Bitcoin Halving is the process in which rewards for mining new blocks on the Bitcoin network are reduced by half every 210,000 blocks, or approximately every 4 years. This mechanism is designed to control the rate of Bitcoin production and keep inflation low.

When reaching a predetermined block (e.g., blocks 210,000, 420,000, 630,000, etc.), the number of Bitcoins miners receive as rewards is halved. For example:

-

2009: Reward 50 BTC

-

2012: Reduced to 25 BTC

-

2016: Reduced to 12.5 BTC

-

2020: Reduced to 6.25 BTC

-

2024: Reduced to 3.125 BTC

This halving process will continue until 2140, the year when the last Bitcoin is expected to be mined.

History of Bitcoin Halving

-

2012: November 28, 2012 – reward reduced from 50 BTC to 25 BTC

-

2016: July 9, 2016 – reward reduced from 25 BTC to 12.5 BTC

-

2020: May 11, 2020 – reward reduced from 12.5 BTC to 6.25 BTC

-

2024: April 20, 2024 – reward reduced from 6.25 BTC to 3.125 BTC

Impact on Bitcoin Price After Halving

Historically, Bitcoin Halving tends to drive the price of Bitcoin upward, mainly due to supply and demand dynamics.

Since Halving reduces the number of Bitcoins miners receive as rewards by half, the supply of new Bitcoins in the market decreases. If buying demand remains the same or increases, the price usually rises to balance the shortage.

Price movements do not happen immediately after Halving but follow a gradual adjustment period, which can last months or even years depending on other factors such as global Bitcoin adoption, economic conditions, and investor behavior.

Many analysts believe Halving is a positive factor for long-term prices because it lowers Bitcoin’s inflation rate, making the asset scarcer and more attractive. However, there is a risk that if demand does not increase accordingly, prices could drop in the short term.

Bitcoin Mining and the Environment (Green Mining)

Bitcoin mining is an energy-intensive process because mining machines must operate 24/7 to solve mathematical equations and validate transaction blocks. This has environmental impacts, particularly in terms of carbon dioxide emissions and high electricity consumption.

To reduce these impacts, many miners are turning to renewable energy sources such as solar and hydro power. Using renewable energy helps lower electricity costs and reduce carbon emissions, making Bitcoin mining more sustainable.

Eco-friendly Mining

The trend of eco-friendly Bitcoin mining is continuously growing. Some mining machine manufacturers and large mining farms have started investing in clean energy projects, including setting up farms in areas with sufficient renewable energy. This ensures Bitcoin mining aligns with sustainability practices and reduces environmental impact.

Is Bitcoin Mining Still Profitable in 2025?

In 2025, Bitcoin mining remains attractive for investors and miners. Although challenges are increasing due to factors such as higher energy prices and increased mining difficulty, there are still opportunities for profit with proper planning and management.

According to CoinDCX in October 2025, Bitcoin’s price ranged between $108,000 and $110,000, with potential to rise further if it breaks the $115,000 resistance level, potentially reaching $120,000 to $130,000 in the short term.

Therefore, for mining Bitcoin with new ASIC models such as Antminer S21 Pro or Whatsminer M60S Sazmining, it is estimated that net profit could be around $30 to $40 per day per TH/s if electricity costs are $0.07/kWh. However, ROI calculations should also consider other factors such as equipment cost, maintenance fees, and increasing mining difficulty.

Trend of Miners Moving Towards Cloud Mining and Hosting Centers

As mining costs with personal equipment rise, many miners are turning to Cloud Mining and Hosting Centers to improve efficiency and reduce operational costs. This allows miners to access high-performance mining power without investing in expensive equipment. They can also utilize renewable energy sources, such as solar or hydro power, supporting eco-friendly mining.

Long-term investors still find holding Bitcoin attractive. Even though mining may have high costs and increased difficulty, after Halving, the Bitcoin supply decreases, maintaining the potential for long-term price appreciation.

For miners, investing in high-performance equipment and using renewable energy can help maintain profitability. While returns may not be as high as during peak price periods, overall, Bitcoin mining in the future can still generate long-term income and remains a viable option for investors.

How to Start Bitcoin Mining for Beginners

-

Study the basics of Proof of Work (PoW): Start by understanding how Bitcoin and PoW work.

-

Choose mining equipment or Cloud Mining: Decide whether to use personal machines (ASIC, GPU) or Cloud Mining services.

-

Create a Wallet for BTC: Prepare a personal wallet to store mined Bitcoin.

-

Join a Mining Pool: Participating in a Mining Pool increases the chance of receiving rewards consistently.

-

Monitor income and profitability: Track mining income and calculate ROI regularly to adjust mining plans for profitability and reduce risk.

Preservation of Bitcoin coins mined

After mining Bitcoin, securely storing your coins is crucial because coins kept in an unsafe Pool or Wallet are at risk of loss or hacking.

Miners need to understand that there are two types of Wallets, each with its own advantages and limitations, affecting security and usability:

-

Hot Wallet: An online wallet or mobile app connected to the internet. Easy to create and use immediately, but highly vulnerable to hacking or theft. Suitable for storing small amounts of coins or coins used frequently for transactions.

-

Cold Wallet: An offline wallet, such as a hardware wallet or paper wallet. Highly secure and suitable for long-term storage of coins.

How to Transfer Coins from a Mining Pool to Your Wallet

-

Log in to your Mining Pool account.

-

Enter your Bitcoin Wallet address.

-

Specify the amount of coins to transfer.

-

Confirm the transaction and wait for it to process.

Regular transfers help reduce the risk of coins remaining in the Pool for too long. You can also set up an Automated System to transfer coins or receive transaction alerts.

Setting Up Automated Systems for Beginners

-

Enable 2-Factor Authentication (2FA) for Pool and Wallet: Adds an extra layer of security; logins or transactions require a code from your mobile device.

-

Backup Seed Phrase or Private Key in multiple secure locations: Multiple backups allow you to recover your Wallet if the main device is damaged or lost.

-

Set regular automated transfers: Automatically transfer coins from the Pool to your personal Wallet regularly to reduce risk of coins staying in the Pool too long.

-

Use transaction alerts via mobile app or email: Receive instant notifications for transactions to monitor for irregularities and reduce the chance of loss.

Buy Bitcoin with KuCoin Thailand instead of mining (for those who don't want to invest in a mining machine)

For beginners or those who don’t want to invest in expensive mining equipment, buying Bitcoin directly from an Exchange platform is a convenient and cost-effective alternative to mining Bitcoin yourself.

Mining Bitcoin requires investing in mining machines, electricity, and maintenance. There are also risks related to energy costs and mining difficulty, although miners gain coins directly and experience technological challenges.

Meanwhile, investors who buy Bitcoin through an Exchange don’t need to invest in mining equipment, don’t need to worry about maintenance, and can buy and sell immediately.

KuCoin Thailand is one of the most attractive options because it meets both convenience and security needs. It allows investors to buy and sell Bitcoin quickly through an easy-to-understand interface. Even beginners can register and start investing today.

Buy Bitcoin easily and safely on KuCoin Thailand — starting from just a few baht.

FAQ – Frequently Asked Questions About Bitcoin Mining

Q1: What is Bitcoin mining, and how is it different from buying?

Bitcoin mining is the process of using computers to solve mathematical puzzles to verify transactions and create new coins. Buying Bitcoin, on the other hand, involves exchanging cash or digital currency to acquire coins immediately without the need for mining hardware.

Q2: How much does a Bitcoin mining machine cost?

The cost depends on the type of mining machine. CPU/GPU setups may start at a few thousand baht, while high-performance ASICs can cost tens of thousands to hundreds of thousands of baht. This does not include electricity and maintenance costs.

Q3: Can I mine Bitcoin at home?

Yes, but you need to prepare a space for machines that may be noisy and produce a lot of heat, along with electricity costs and cooling solutions. If not feasible, you might consider Cloud Mining or simply buying Bitcoin instead.

Q4: Why does the Bitcoin mining reward decrease over time?

Because of Bitcoin’s Halving mechanism, mining rewards are reduced by half every 4 years to control supply, limiting the number of new coins released into the market.

Q5: Is Bitcoin mining still profitable in 2025?

It can still be viable for investors with high-performance machines and low electricity costs, but it’s important to monitor market prices, mining difficulty, and calculate all costs carefully.

Summary – What is Bitcoin Mining and Who Is It Suitable For?

Bitcoin mining is the process of using computers to solve mathematical equations to verify transactions and create new coins via the Proof of Work system, a key mechanism that ensures the Bitcoin network is secure and trustworthy.

Mining allows investors to acquire coins directly and potentially profit from price increases. However, it comes with high initial costs, including mining hardware, electricity, cooling systems, and the risk of Bitcoin price volatility.

Advantages of mining:

-

Acquire coins directly

-

Support the Blockchain network

-

Potential for profit if Bitcoin prices rise

Disadvantages of mining:

-

High upfront costs

-

Increasing mining difficulty each year

-

Risk of equipment damage

For beginners or those unwilling to make a heavy investment, buying Bitcoin through a reliable trading platform like KuCoin Thailand may be a better choice. There’s no need to invest in mining machines, worry about electricity or maintenance, and you can start investing with a small amount while trading safely and immediately.

[Bitcoin Halving Source]

https://www.ey.com/en_ch/insights/blockchain/the-bitcoin-halving-explained

https://charts.bitbo.io/halving-dates/

https://bravenewcoin.com/insights/bitcoin-btc-price-prediction-bitcoin-poised-for-150k-as-halving-cycle-and-us-government-shutdown-drive-rally

https://www.investopedia.com/bitcoin-halving-4843769

https://www.kraken.com/learn/bitcoin-halving-history

⚠️ Disclaimer: Cryptocurrency and digital token involve high risks; investors may lose all investment money and should study information carefully and make investments according to their own risk profile.

KuCoin Thailand

(Operated by ERX Company Limited)

Email: happy@kucoin.th

- Website: www.kucoin.th

- Facebook: facebook.com/KuCoinThailand

- Facebook Community Group: facebook.com/groups/kucointhailandcommunity

- LINE Official Account: @KuCoinThailand

- Instagram: Kucointhailand

- X (formerly Twitter): x.com/KuCoinThailand

- Telegram: @KuCoinTH_Official

📲 Download the KuCoin Thailand app today!

👉 Click here to download Available now on both the Thailand App Store and Play Store.