What is token? Basic knowledge every crypto investor should know before venturing into the digital world.

A token is a digital asset created on a blockchain, used for transferring value, accessing services, and functioning differently from coins that have their own blockchain. Let's learn about the usage, types, and importance of tokens in the cryptocurrency world.

What is a Token? Basic knowledge crypto investors should know before entering the digital world

What is a Token?

Before understanding the term Token, it’s helpful to first look at cryptocurrency and how it relates to tokens.

Cryptocurrency is a digital asset that operates on a decentralized system, which includes major digital currencies like Bitcoin and Ethereum, as well as other assets created on blockchain networks to serve specific functions in the digital world. These specialized assets are what we call tokens.

Tokens play a key role in driving projects, providing utility, access rights, and forming an internal economic system within a blockchain network.

The meaning of “Token” in the crypto world

A token is a digital asset created and managed through smart contracts on a blockchain. Typically, tokens do not have their own blockchain, but rely on the infrastructure of major networks like Ethereum, BNB Chain, or Solana.

Tokens can serve multiple roles, including:

-

Access rights: Using tokens to participate in games, DeFi platforms, or other services.

-

Value representation: Holding tokens to exchange for goods or services within the project ecosystem.

-

Incentive mechanisms: Rewarding users or contributors to encourage engagement and development.

-

Real-world asset representation: Tokens can represent stocks, gold, real estate, or other tangible assets.

Why were tokens created in the digital financial system?

Tokens allow projects to create their own economic systems without building a new blockchain, reducing costs while offering flexibility in designing features.

Tokens solve several problems, such as:

-

Reducing network development costs: No need to create a new blockchain from scratch.

-

Managing user rights and ecosystem roles: Token holders can access services or vote on decisions within the network.

-

Transparent fundraising for projects: Token sales or ICOs allow the community to participate from the start.

-

Enhancing transaction transparency: Token movements are recorded on the blockchain and can be audited.

-

Supporting flexible and diverse use cases: Developers can design tokens specifically to meet their project goals.

The relationship between Tokens and Blockchain

Tokens rely on blockchain networks for their creation, management, and security. While the blockchain provides the underlying infrastructure—handling transactions, validation, and consensus—tokens function as the units of value or utility within a specific project ecosystem.

Essentially:

-

Blockchain = the digital infrastructure

-

Token = the asset or tool that operates on top of that infrastructure

Tokens leverage blockchain technology to deliver programmable, tradable, and verifiable digital assets, enabling projects to operate efficiently without building an entirely new blockchain.

The relationship between Tokens and Blockchain

Although a token is a digital asset, its entire mechanism relies on a blockchain, with smart contracts defining rules such as token supply, transfers, locking, and other economic functions. While the blockchain serves as the infrastructure, the token is the asset or tool that operates on top of it.

Why Tokens are the heart of the cryptocurrency ecosystem

Tokens enable crypto ecosystems to function fully, including:

-

Building internal project economies

-

Decentralizing decision-making

-

Sustaining platform and community development

-

Connecting developers, investors, and users

Without tokens, many DeFi, GameFi, and DApp projects could not operate efficiently or achieve their intended functionality.

Common types of tokens in the crypto market

-

Utility Tokens: Used for fees or accessing services (e.g., UNI, BNB)

-

Governance Tokens: Used to vote on or influence project direction (e.g., AAVE, COMP)

-

Stablecoins: Pegged to a stable asset (e.g., USDT, USDC)

-

Asset-backed / Security Tokens: Represent real-world assets like gold or real estate

-

Game Tokens / NFT Tokens: Used in games or NFT platforms (e.g., AXS, SAND)

Difference Between Coins and Tokens

While the text stops here, the next section would explain the distinction:

-

Coin: A cryptocurrency with its own blockchain (e.g., Bitcoin, Ethereum) used primarily as a medium of exchange or store of value.

-

Token: A digital asset that operates on top of an existing blockchain, used for utility, governance, or representing other assets.

Tokens leverage blockchain infrastructure, while coins represent native network currencies.

What is the difference between a coin and a token?

For newcomers to crypto, understanding the difference between coins and tokens is fundamental. Both play different roles, have distinct functions, and carry different risks.

The clearest example of a coin is Bitcoin (BTC), the most famous cryptocurrency. Unlike tokens, coins operate on their own blockchain and function as the native currency of that network.

Check the price of Bitcoin today on KuCoin’s website and to get the latest updates on tokens.

How Coins Work on Their Own Blockchain

A coin is the primary currency of its blockchain and serves as the unit of value within that network. Examples: Bitcoin (BTC) on the Bitcoin network, Ether (ETH) on the Ethereum network.

Key characteristics:

-

Native currency of the network: All transactions are recorded as coin transfers, used for payments, fees, or miner/validator rewards.

-

Own ledger and security system: Consensus mechanisms validate transactions and create new blocks, forming the network’s security foundation.

-

Coin issuance and monetary policy: Networks define coin release schedules, affecting supply and economic dynamics.

Advantages: Full independence in protocol design.

Challenges: Responsible for all security and infrastructure development.

Tokens: Assets Built on Another Blockchain

A token is a digital asset created on an existing blockchain, often on networks supporting smart contracts such as Ethereum, BNB Chain, or Solana.

Key characteristics:

-

Created via smart contracts: Developers program rules for creation, transfer, and features, deploying them on the host blockchain.

-

Dependent on host blockchain infrastructure: Security, transaction validation, and fees rely on the main network.

-

Highly flexible: Can function as utility tokens, governance tokens, stablecoins, NFTs, etc.

-

Easier issuance and management: No need to build a new blockchain, reducing cost and development time.

Pros and Cons of Coins and Tokens

Coin

Advantages:

-

Serves as the native currency of its blockchain.

-

Full control over protocol adjustments.

-

Widely recognized as a primary digital asset (e.g., BTC, ETH).

Disadvantages:

-

High investment needed for infrastructure and security.

-

Protocol development and upgrades can be complex and time-consuming.

-

Some networks may experience high fees during periods of heavy usage.

Token

Advantages:

-

Faster and cheaper to create and deploy.

-

Highly flexible, with project-specific functions.

-

Benefits from the security and infrastructure of the host blockchain.

Disadvantages:

-

Dependent on the host network; if the network experiences issues, the token is affected.

-

Limited customization, as the core of the host blockchain cannot be changed.

-

High competition, as creating tokens is easier than creating a new coin.

Coin vs Token Comparison Table

|

Feature |

Coin |

Token |

|

Network |

Own blockchain (e.g., Bitcoin, Ethereum) |

Built on another blockchain (e.g., ERC-20 on Ethereum) |

|

Main Purpose |

Digital currency within the network (transfer/store value) |

Project-specific use (platform features, access rights, voting, rewards) |

|

Security & Infrastructure |

Relies on miners/validators of its own chain |

Depends on the security of the host blockchain |

|

Issuance |

Controlled by protocol (e.g., Bitcoin Halving) |

Issued by projects via smart contracts |

|

Flexibility |

Less flexible, mainly used as money or network’s main currency |

Highly flexible, can be tailored for project needs |

|

Examples |

BTC, ETH, BNB |

UNI, AXS, USDT, SAND |

Although coins and tokens are both digital assets, their roles are clearly different:

-

Coins act as the native currency of their blockchain. They are used for value transfer, network security, and as the “fuel” that powers blockchain operations.

-

Tokens are created on another blockchain and are often designed for specific purposes, such as granting access rights, enabling platform functions, or representing the value of a project.

What are the different types of tokens? Here's a list of token types you should know.

What is a Utility Token and How is it Used?

A Utility Token is created to grant access to a platform’s functions, services, or products. Examples include paying fees, unlocking features, or use within games and apps.

-

Key feature: Focused on practical usage (utility) rather than pure speculation.

-

Examples: UNI (used in Uniswap), SAND (used in The Sandbox).

What is a Security Token and Legal Regulations

A Security Token has characteristics similar to traditional securities, such as stocks, bonds, or investment contracts.

-

Often grants rights to returns, dividends, or project revenue shares.

-

Subject to investment regulations in each country; holders must undergo verification and comply with strict rules.

What is an Investment Token and How It Differs from a Security Token

An Investment Token is designed to raise funds or provide some form of return to holders, such as a share of project revenue.

-

Unlike Security Tokens, Investment Tokens may not always be legally classified as securities.

-

The distinction depends on local laws, as some countries categorize Investment Tokens separately from traditional stocks.

What is a Payment Token and Can It Be Used for Payments?

A Payment Token is created to function as a medium of exchange, like buying goods, services, or transferring value.

-

Example: Litecoin (LTC), or tokens recognized for payments in certain countries.

-

Real-world usage depends on merchant acceptance and local regulations.

What is a Governance Token and Its Role in a DAO

A Governance Token gives holders the right to vote and participate in decision-making for a protocol or platform.

-

Decisions can include feature updates, budget allocation, or rule changes.

-

Often linked to DAOs (Decentralized Autonomous Organizations), which replace traditional management with community voting.

-

Examples: MKR, AAVE, UNI.

Are Stablecoins Considered Tokens?

Yes, Stablecoins are a type of token pegged to reference assets such as the USD (USDT, USDC), gold, or other cryptocurrencies.

-

Purpose: Price stability compared to regular tokens.

-

Common uses: transfers, trading, or temporary storage during volatile markets.

Examples of Real-World Tokens in the Crypto Market

-

UNI: Governance and fee token in Uniswap

-

LINK: Oracle services in Chainlink

-

USDT / USDC: Stablecoins for payments and trading

-

SAND / AXS: Used in gaming and Metaverse ecosystems

These tokens are designed for various use cases, ranging from finance, gaming, governance, to connecting the real world with digital platforms.

The evolution of tokens from the past to the present.

Early Era: Utility Tokens on Ethereum

The first significant wave of tokens emerged on Ethereum, which allowed developers to easily create digital assets through the ERC-20 standard.

-

Early tokens were mostly Utility Tokens used to pay fees, access services, or support platform economies.

-

Their simplicity enabled many projects to adopt blockchain in practical ways.

DeFi Era and the Rise of Governance Tokens

With the growth of DeFi around 2020, Governance Tokens became popular, giving holders the right to vote and participate in protocol management.

-

Examples: UNI, AAVE, COMP.

-

Tokens were no longer just for utility—they also represented decision-making power in decentralized networks.

NFT Era and Real-World Tokenization

-

NFTs (Non-Fungible Tokens): Unique digital tokens that cannot be exchanged one-to-one, allowing creators, artists, and brands to digitally represent ownership on blockchain.

-

Tokenization of real assets: Converts physical assets like real estate, stocks, or gold into digital tokens for easier trading.

-

This bridged traditional finance with blockchain technology.

Modern Tokens: From Web3 to Metaverse and AI

Tokens now integrate with Web3, Metaverse, and AI. Examples include:

-

Tokens as mediums in virtual worlds

-

Tokens linked with AI systems

-

Tokens supporting decentralized Internet infrastructure

This trend shows tokens are evolving from digital assets to digital economic structures supporting diverse use cases.

How Tokens Work on Blockchain

Core Infrastructure: Smart Contracts

Tokens rely on Smart Contracts, programs on blockchain that execute automatically and cannot be altered.

Key components of a token:

-

Token Ledger: Records balances of all holders transparently.

-

Transfer Function: Controls token transfers and enforces project-specific rules.

-

Minting & Burning: Manages supply, creating or destroying tokens as needed.

-

Rights & Restrictions: Sets holder privileges, e.g., token lockups or governance voting rights.

-

Integration with DApps/Platforms: Allows tokens to function as mediums in DeFi, games, or other services.

Popular token creation standards.

|

Standard |

Blockchain |

Common Use Cases |

|

ERC-20 |

Ethereum |

Utility, Governance, Stablecoins |

|

BEP-20 |

BNB Chain |

DeFi, DApps, low fees, fast transactions |

|

TRC-20 |

Tron |

Fast payments, gaming, low-cost transfers |

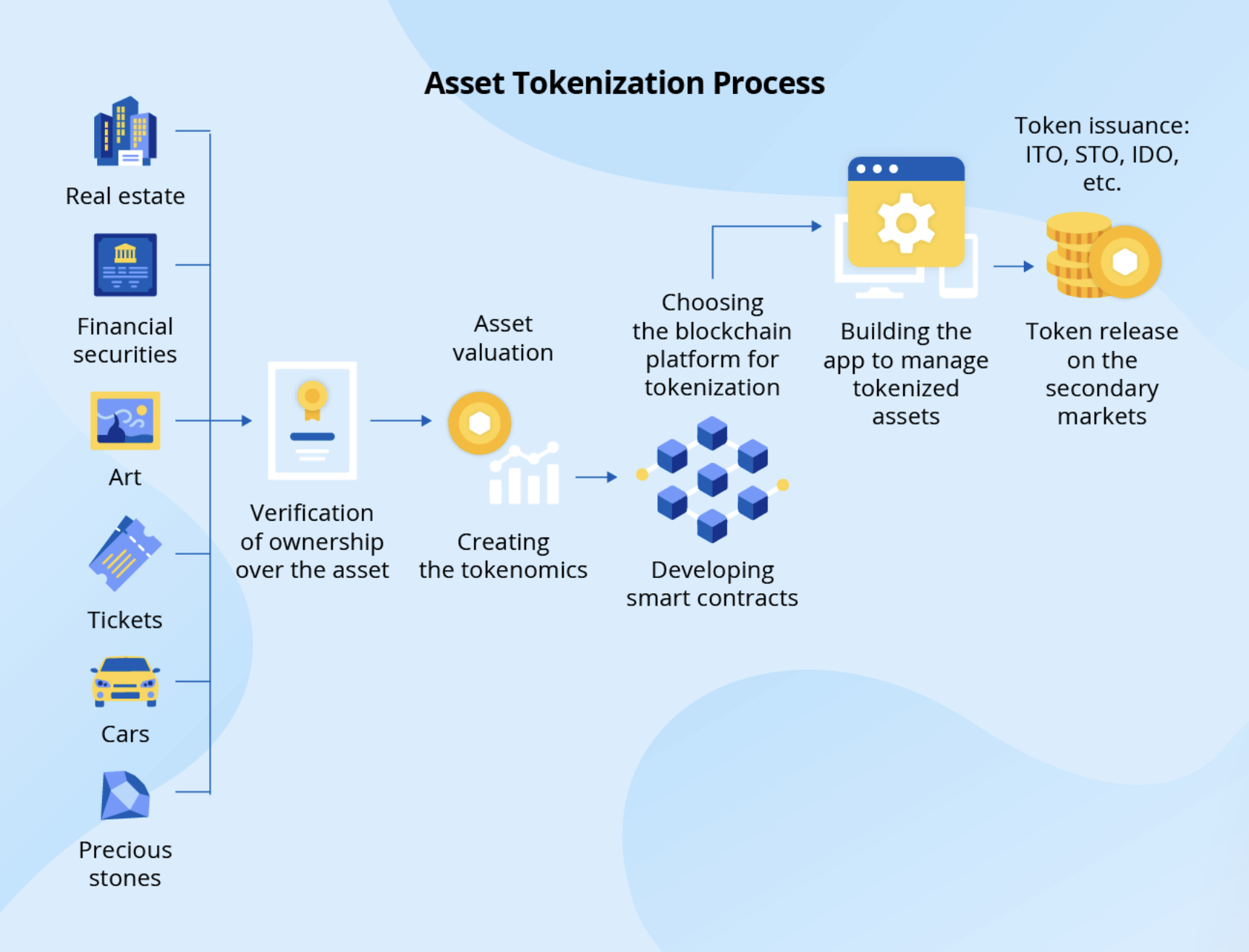

The process of issuing new tokens (Tokenization Process)

Thanks to Scnsoft for the image.

The key steps in creating a token are as follows:

Choose the asset to be tokenized: Start by determining which asset will be tokenized. It can be a real-world asset, such as real estate, stocks, or gold, or it can be a digital asset.

Design and define the type of token: Decide what type of token will be issued, such as utility, security, governance, or asset-backed tokens, and define the token’s economic model.

Select the appropriate blockchain and platform: Choose a blockchain network that supports smart contracts and meets the project’s needs, such as in terms of security, cost, and speed.

Develop the Smart Contract for the token: Write a smart contract that defines the rules for the token, such as issuance, transfers, holding, and compliance with regulations.

Issue the token and allow holding and trading: Investors can hold and use the token.

Burning and Staking Tokens

Burning (Burn) is the process of destroying tokens to reduce the total number in the system, creating scarcity and potentially supporting market prices.

Staking a token involves locking tokens in a protocol to support a DeFi system or to earn rewards, such as interest, returns from voting, or special access rights. Staking also helps maintain the security and stability of the network.

Tokens in DeFi and DApps

Tokens are a critical component of DeFi and DApps because they can be used as a medium for transactions, rewards, or governance voting within a platform. Tokens allow users to create value and directly participate in the system without relying on intermediaries, resulting in a decentralized economy that is transparent and auditable.

What is Tokenomics? Understanding the Token Economy

Token Supply and Demand

Defining supply and demand is at the heart of tokenomics.

-

Supply: The total number of tokens in the system, divided into Total Supply (all tokens that can exist) and Circulating Supply (tokens in circulation in the market).

-

Demand: The demand for using tokens within the platform, such as participation in DApps, payments, or staking.

Token Distribution and Allocation

Token distribution, or allocation, is another crucial factor that affects the stability and fairness of the token system. Tokens may be distributed to founders, development teams, major investors, retail holders, or used as rewards for users. Distribution must be balanced to prevent the concentration of tokens in the hands of a single group, which could lead to price manipulation.

Inflation vs. Deflation in the Token World

-

Inflation: Continuous increase in token supply can reduce the value of each token, for example, issuing new tokens without control.

-

Deflation: Reducing the number of tokens, such as burning tokens or locking them through staking, creates scarcity and may increase their value.

Mechanisms That Affect Token Value

The value of a token is determined by several factors, including:

-

Supply and demand: The number of tokens in the market relative to the demand for usage.

-

Actual usage: Tokens that are used frequently in DApps or DeFi systems tend to have higher value.

-

Project credibility: The development team, financial structure, and roadmap influence investor confidence.

-

Incentive mechanisms: Such as staking to earn rewards or burning tokens to reduce supply.

-

Overall crypto market conditions: Prices of Bitcoin and other major coins often influence token value.

Examples of Real-World Token Use

Tokens in Finance and Investment

Tokens are used in digital finance systems to increase transparency and reduce the role of intermediaries. Payment tokens are used for transactions between merchants and consumers, while security tokens represent traditional assets, such as stocks or bonds.

Tokens in Real Estate

Investors can hold shares of buildings, homes, or large projects in digital form, with tokens representing ownership rights. This makes real estate transactions more flexible and allows investments with lower initial capital than purchasing full ownership.

Tokens in Gaming and NFTs

Tokens play a key role in the gaming and NFT industries, representing in-game assets such as items or characters, which can be traded, exchanged, or collected.

Tokens in Entertainment and Art

Artists and creators use tokens as a tool to generate income, for example, by issuing tokens to sell music, films, or artwork. Token holders can access exclusive privileges, such as early viewing or voting rights, and it can also create reward systems for fans.

Tokens in Loyalty Programs and Membership Systems

Many platforms have started using tokens to replace traditional points, such as reward tokens for VIP members or loyalty program tokens, which can be redeemed for products, services, or discounts.

Tokens for Donations and Social Projects

Tokens can be used as a transparent tool for donations or supporting social projects. For example, tokens can be used to raise funds for environmental conservation or allow holders to vote on which projects to support. This ensures that donations are verifiable and increases donor confidence.

The Importance of Tokens in the Digital Economy

Tokens are an essential element of the digital economy. They enable investment, participation, and value creation, connecting investors, developers, and users. Tokens support DeFi, DApps, gaming, NFTs, and real-world asset tokenization, helping to build a transparent, decentralized, and sustainable economic system in the digital world.

The importance of tokens to the digital economy.

Thanks to Nu10 for the image.

The Role of Tokens in the New Economy (Token Economy)

In a Token Economy, the value of tokens on the blockchain enables platforms to directly grant users access rights, rewards, or shares of benefits. This allows platforms to create their own internal economies, making decentralization a practical reality.

Changes in Business in the Era of Tokenization

Businesses can efficiently convert assets and processes into tokenized forms. For example, real estate, stocks, or event tickets can become more accessible to the public because these assets can be divided into smaller units. This provides businesses with new fundraising channels, reduces management costs, and allows access to global investors without relying on traditional intermediaries.

The Future Trend of Tokens

In the future, tokens will play an increasingly significant role across all sectors of the economy, from small transactions and fundraising to representing real-world assets and driving decentralized autonomous systems (DAOs). In addition, tokens will be able to integrate with emerging technologies, such as AI, the Metaverse, and next-generation blockchain networks, increasing the diversity of their applications.

Risks and Precautions Regarding Tokens

Although tokens are a crucial component of the digital economy, investing in or using them carries risks that must be carefully understood.

Risks from investing in tokens with no real value

Many tokens are created without clear use cases, lack a supporting user community, or do not have a solid business model. These tokens are often designed for short-term speculation. When market interest declines, prices can drop rapidly, and investors who purchase without proper research may face significant losses.

What are Scam Tokens and Rug Pulls?

A Scam Token is a token specifically created to deceive investors, such as artificially inflating the price before selling all tokens. A Rug Pull is another form of fraud where the project suddenly shuts down because the developers withdraw tokens from the market, causing the price to crash to zero almost immediately. Both types of risks are common in the crypto world and have caused substantial losses to investors.

How to Verify Whether a Token Project is Trustworthy

Check the development team and their track record

Examine whether the founders and team have real experience in blockchain or technology and whether they have successfully completed projects before.

Review the project roadmap

A good project should have a clear plan, achievable goals, and regular progress updates.

Study the whitepaper

The whitepaper should include use cases, the token mechanism (tokenomics), the problems the project aims to solve, and future development plans.

Check the transparency of blockchain transactions

For example, verify how long liquidity is locked and whether there is any unusual token movement history.

Check smart contract audits

Trustworthy projects often undergo code review by experts or external auditing firms to reduce risks from vulnerabilities or non-transparent coding.

Examine community size and engagement

Projects with large followings and regular communication are generally more reliable than projects with little information or artificially created hype.

Legal Regulations of Tokens in Thailand

In Thailand, the issuance and trading of tokens are regulated by the Securities and Exchange Commission (SEC). Regulations cover digital token issuance, fundraising through tokens (ICOs), and digital asset exchange services. Investors should verify that the platforms they use are properly licensed under the law.

Frequently Asked Questions about Tokens

What can tokens be used for?

Tokens have multiple uses. They can serve as an internal platform currency, access rights to services, means of exchanging goods or services, and rewards for users or system developers. Additionally, tokens can function as governance tokens to vote and make decisions within a project.

How are tokens different from coins?

Coins are digital currencies that have their own blockchain, such as Bitcoin or Ethereum. Tokens, on the other hand, are created on someone else’s blockchain, such as ERC-20 tokens on Ethereum.

How are tokens different from NFTs?

NFTs (Non-Fungible Tokens) are unique tokens that cannot be replaced, such as digital art or in-game items. Regular tokens are interchangeable and can be used for transactions or as a currency within a platform.

What is tokenization?

Tokenization is the process of converting real-world assets or rights into tokens on the blockchain, allowing them to be traded, held, or divided into smaller units transparently and verifiably.

How can tokens increase in value?

The value of tokens depends on supply and demand, real usage within the platform, holder confidence, and mechanisms such as token burning (burn) or locking tokens to create scarcity.

What is the future of tokens?

Tokens will play a critical role in Web3, DeFi, the Metaverse, and the tokenization of real-world assets. They will also integrate with AI and IoT, helping to build a new, flexible, transparent economy that allows more users and investors to participate.

Summary: What Are Tokens? Basic Knowledge Crypto Investors Should Know Before Entering the Digital World

Tokens are one of the essential components of the modern digital economy. They act as representatives of value, rights, or functionality within blockchain systems, enabling applications in the crypto world to connect users, businesses, and developers effectively. Understanding tokens is fundamental for beginners because it helps them recognize the differences between asset types, the role of tokens in various projects, and the risks involved.

Overall, tokens are not only a medium for transactions but also the core of innovation, including Web3, DeFi, NFTs, and the tokenization of assets. Their role will become increasingly significant in the digital financial world of the future.

⚠️ Disclaimer: Cryptocurrency and digital token involve high risks; investors may lose all investment money and should study information carefully and make investments according to their own risk profile.

KuCoin Thailand

(Operated by ERX Company Limited)

Email: happy@kucoin.th

- Website: www.kucoin.th

- Facebook: facebook.com/KuCoinThailand

- Facebook Community Group: facebook.com/groups/kucointhailandcommunity

- LINE Official Account: @KuCoinThailand

- Instagram: Kucointhailand

- X (formerly Twitter): x.com/KuCoinThailand

- Telegram: @KuCoinTH_Official

📲 Download the KuCoin Thailand app today!

👉 Click here to download Available now on both the Thailand App Store and Play Store.