The Relationship Between Digital Assets and Monetary Policy

Digital assets are privately created property. Under Thai law, they qualify as intangible property pursuant to Section 138 of the Civil and Commercial Code. However, most digital assets are created without any linkage—of any kind—to other assets in the physical world, particularly those known as “unbacked crypto asset.” Currently, the regulation of digital assets primarily focuses on market intermediaries, such as exchanges or financial service providers, rather than on the assets themselves. A digital asset creation project becomes subject to regulatory oversight only when it involves fundraising risks through the offering of digital assets to retail investors in the primary market (initial coin offering).

Although the business models, legal structures, and regulatory approaches outlined above suggest that the development of the digital asset market is independent from the state—reflecting the ethos of its early pioneers—in reality, digital assets, especially the most popular types, are inevitably linked to government policy.

A clear example of the desire to create a financial system independent of state control can be found in the Bitcoin whitepaper

When examining the relationship between other investment assets—such as equities or gold—and changes in the policy interest rate, it is generally observed that a central bank’s decision to lower interest rates increases liquidity in the system. This reduces borrowing costs for businesses, thereby stimulating investment and the launch of capital-intensive projects. Governments may also employ other tools to complement an accommodative monetary policy stance, such as repurchasing government bonds from investors or lowering the statutory reserve requirement for regulated financial institutions. Consequently, stock markets often rise following a policy rate cut, as investors anticipate that economic stimulus will lead to improved corporate earnings. Conversely, when the central bank raises the policy rate—often alongside other tightening measures—it signals that economic growth is slowing or that inflation is becoming uncomfortably high. In such circumstances, investors tend to sell equities in favor of lower-volatility assets such as gold, cash, or government bonds.

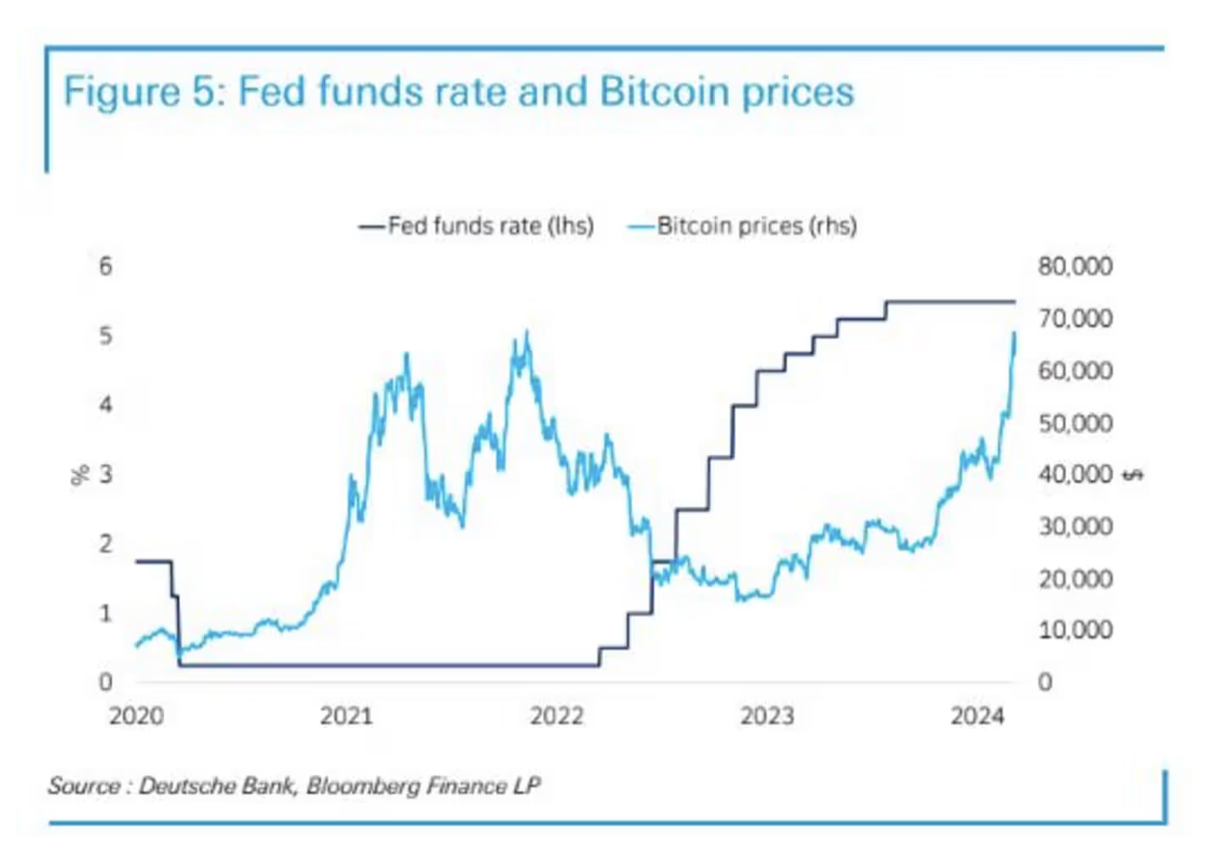

The connection between digital assets and state policy becomes even more evident when considering the volatility of digital asset prices in relation to monetary policy—one of the key tools used by economic regulators, such as the Bank of Thailand, to manage the economy and mitigate volatility affecting the public, investors, and businesses.

An analysis of price movements in major global digital assets—such as Bitcoin, Ether, and other significant tokens—shows a meaningful correlation with monetary policy decisions. In particular, U.S. monetary policy, set by the Federal Reserve, provides a clear case study, as summarized in the table below.

Figure 1: Summary data from MarketWatch

Figure 1: Summary data from MarketWatch

The data indicates that digital asset price movements resemble those of other high-risk securities. During periods when the central bank cuts interest rates, digital asset prices (in this case, Bitcoin) tend to rise. In a low-interest-rate environment, investors are generally more tolerant of market volatility and risk, seeking assets that can deliver higher returns than government bonds or listed equities.

Furthermore, despite being designed by the private sector to resist external interference, digital assets now exhibit price behavior similar to other securities and investment products. This suggests that the digital asset ecosystem is evolving toward greater integration with broader capital markets.

⚠️ Disclaimer: Cryptocurrency and digital token involve high risks; investors may lose all investment money and should study information carefully and make investments according to their own risk profile.

KuCoin Thailand

(Operated by ERX Company Limited)

Email: happy@kucoin.th | Call Center: 02-080-6060

- Facebook: facebook.com/KuCoinThailand

- Instagram: Kucointhailand

- LINE Official Account: @KuCoinThailand

- X (formerly Twitter): x.com/KuCoinThailand

- Tiktok: @KuCoinThailand

- Telegram: @KuCoinTH_Official

- Facebook Group: KuCoin Thailand Official Community

📲 Download the KuCoin Thailand app now!

👉 Click here to download Available on the Thailand App Store and Play Store.

⚠️ คำเตือน: คริปโทเคอร์เรนซี และโทเคนดิจิทัล มีความเสี่ยงสูง ท่านอาจสูญเสียเงินลงทุนได้ทั้งจำนวน โปรดศึกษาและลงทุนให้เหมาะสมกับระดับความเสี่ยงที่ยอมรับได้

KuCoin Thailand

(ดำเนินงานโดยบริษัท อีอาร์เอ็กซ์ จำกัด)

Email: happy@kucoin.th

- Website: www.kucoin.th

- Facebook: facebook.com/KuCoinThailand

- Facebook Community Group: facebook.com/groups/kucointhailandcommunity

- LINE Official Account: @KuCoinThailand

- Instagram: Kucointhailand

- X (formerly Twitter): x.com/KuCoinThailand

- Telegram: @KuCoinTH_Official

📲 ดาวน์โหลดแอป KuCoin Thailand ได้แล้วตอนนี้!

👉 คลิกที่นี่เพื่อดาวน์โหลด พร้อมให้บริการทั้งบน App Store และ Play Store ประเทศไทย