Stablecoin as a safe haven asset: Summary of the latest research

Stablecoins are digital tokens issued on decentralized ledger networks or blockchains, with issuers promising to holders that these tokens will maintain a value equal to the referenced assets being held, and can be exchanged for each other at a rate that is equal or nearly equal—for example, one token equals one US dollar. Stablecoin issuers must uphold this promise by holding the referenced assets or assets that can be exchanged for the referenced assets without loss of value. For instance, if a stablecoin is pegged to the US dollar, the project owner may hold US government bonds, high-quality commercial paper, repurchase agreements (repo), and US dollar-denominated bank deposits, etc.

This commitment is similar to the business operations of financial institutions such as banks. In the case of commercial banks, the bank is a debtor to the depositors, who have the legal right of on-demand withdrawal. If the bank holds illiquid assets that cannot be converted into cash in time, it may face the problem known as a bank run.

Looking back at stablecoin projects, it can be seen that these token issuers are engaging in “liquidity transformation,” which can pose bank run risks as well if risk management is not sufficiently robust.

Therefore, in theory, we can say that the balance sheet structure of stablecoin projects closely resembles that of money market funds (MMFs). When the digital asset market is under pressure, most digital asset investors behave similarly to money market fund investors: they tend to sell high-risk digital assets en masse and flock to low-risk stablecoins (flight-to-quality).

This phenomenon is similar to what occurred with money market funds during the global financial crisis in 2008–2009 and during the COVID-19 pandemic, when investors in risky financial instruments sold those assets to hold safer instruments like gold or US government bonds instead.

Can we now consider stablecoins to have become safe haven assets in the capital market?

Recent research from the European Central Bank found that stablecoins cannot yet serve this function.

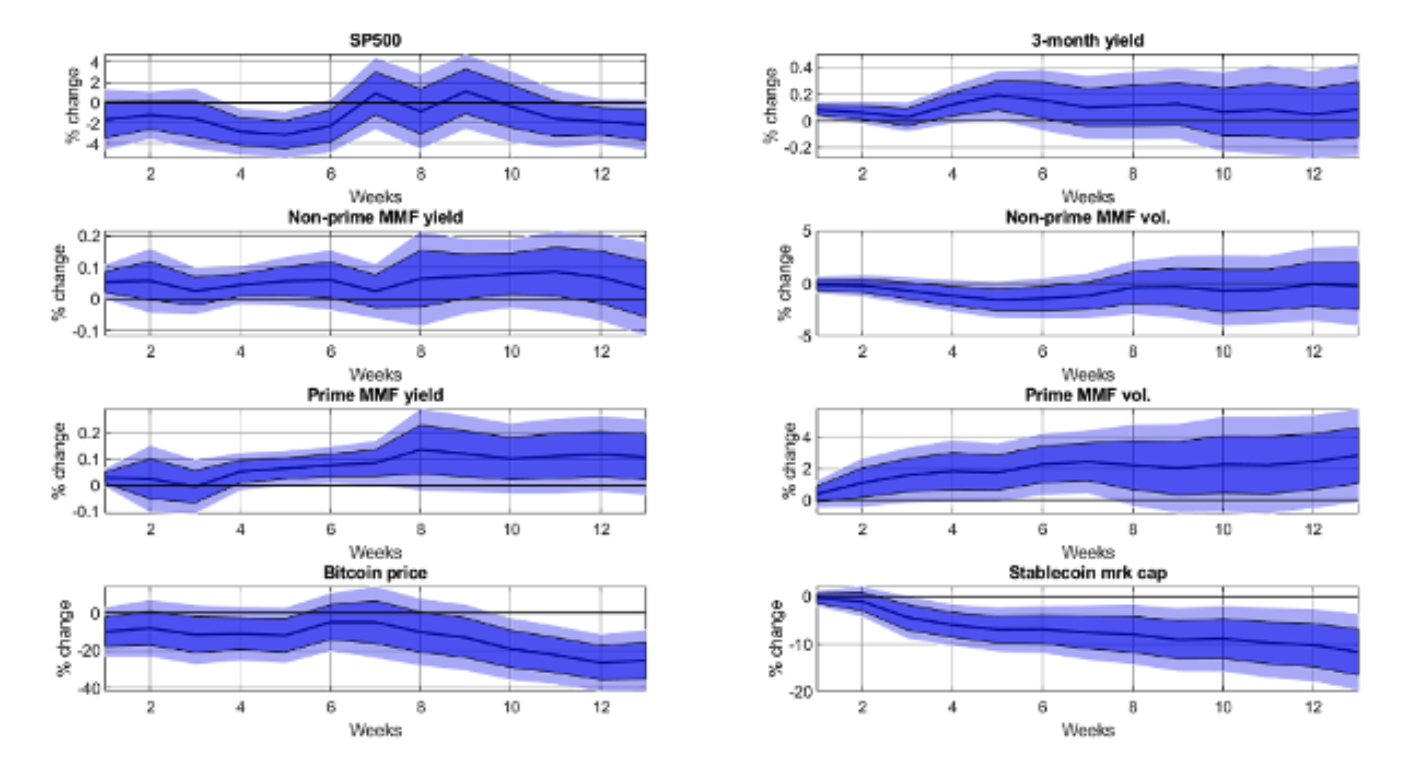

The researchers pointed out differences between stablecoins and money market funds in their response to US monetary policy changes since 2019. This new set of data reveals that since 2019, crises in the digital asset world have had no impact on money market funds or other financial markets. However, when the Federal Reserve abruptly tightens monetary policy, investors turn away from stablecoins and instead buy into high-quality money market funds (three-month prime funds).

Figure 1. Data showing how each market type behaves in response to the U.S. Federal Reserve’s contractionary monetary policy

Figure 1. Data showing how each market type behaves in response to the U.S. Federal Reserve’s contractionary monetary policy

(Source:https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2987~1919e51abf.en.pdf)

In summary, stablecoins overall do not serve as “safe haven assets” against shocks from crypto or general financial shocks. When the Federal Reserve tightens monetary policy, the prices of digital assets fall, the market enters a bear market, and investor demand for stablecoins decreases. This is because stablecoins function primarily as transaction settlement tools for speculation in digital asset markets. Thus, US dollar monetary policy becomes a vital link between traditional financial markets and this new type of investment market.

⚠️ Disclaimer: Cryptocurrency and digital token involve high risks; investors may lose all investment money and should study information carefully and make investments according to their own risk profile.

KuCoin Thailand

(Operated by ERX Company Limited)

Email: happy@kucoin.th

- Website: www.kucoin.th

- Facebook: facebook.com/KuCoinThailand

- Facebook Community Group: facebook.com/groups/kucointhailandcommunity

- LINE Official Account: @KuCoinThailand

- Instagram: Kucointhailand

- X (formerly Twitter): x.com/KuCoinThailand

- Telegram: @KuCoinTH_Official

📲 Download the KuCoin Thailand app today!

👉 Click here to download Available now on both the Thailand App Store and Play Store.