Trading Rules

As a digital asset exchange providing electronic matching services for digital assets transaction, the Company has established digital assets trading rules to ensure fairness and orderliness in trading practices. The relevant rules are as follows:

1.Process of trading and exchanging digital assets through the trading system

Trading system matches orders by using an Automatic Order Matching (“AOM”) system, prioritizing orders based on price-time priority.

-

Price-Time Priority – Upon submission of a buy or sell order, the trading system records the timestamp of the order and prioritizes the order based on price and time.

- Buy orders are prioritized by bid price, with the highest bid ranked first. If a higher bid is submitted, it immediately takes precedence and is placed at the front of the order book. In the event of multiple buy orders at the same price, time priority applies, with the earliest submitted order ranked first.

- Sell orders are prioritized by asking price, with the lowest asking price ranked first. If a lower asking price is submitted, it immediately takes precedence and is placed at the front of the order book. In the event of multiple sell orders at the same price, time priority applies, with the earliest submitted order ranked first.

- Matching Order – Upon submission of a buy or sell order into the trading system, the system assessed the order for an immediately match. If a match is found, the trade is immediately executed (Taker). Otherwise, the order is prioritized according to Price then Time priority, as previously described, pending a future match based on its order type (Maker).

- The submission of buy or sell orders for digital assets on the Company’s exchange platform is subject to a minimum order volume as determined by the Company on a case-by-case basis. The minimum order volume for each digital asset varies and will be disclosed on the Company’s website, with examples as follows:

Examples

| Digital token | Minimum quantity for trading |

| SiriHub A | 1 |

| SiriHub B | 1 |

| XTZ | 0.00000001 |

| USDC | 0.000001 |

- Buy or sell orders placed in THB can be submitted with 2 decimal places.

- Buy or sell orders for digital assets can be submitted with up to 8 decimal places, depending on the asset. Mathematical rounding principles are applied, values >=5 are rounded up, and the values <5 are rounded down.

2.Order placement procedures

- Buy orders submission: To place a digital asset buy order, customers must have sufficient funds or cryptocurrencies, as specified in the list of cryptocurrencies approved by the Securities and Exchange Commission (“SEC”) for digital token issuer or digital asset service providers. The list pertains to SEC-specified cryptocurrencies (in case where cryptocurrency-based digital asset matching services are offered). These funds must cover the digital asset price, fees, taxes, and any other related expenses.

- Sell orders submissions: To place a digital asset sell order, customers must have sufficient cryptocurrencies for placing a sell order, including fees, taxes and any other related expenses.

- Customers are prohibited from trading or exchanging digital assets with any fiat currencies or cryptocurrencies other than those included in the list of cryptocurrencies approved by the SEC for digital token issuer or digital asset service providers.

3.Digital asset settlement and delivery

3.1 Procedures for Digital asset settlement and delivery

For settlement, the buyer must have sufficient Thai Baht or designated cryptocurrency for the purchase, and the seller must have sufficient digital assets for the sale, as specified in the section 2 Order placement procedures. Upon the placement of a buy order by the buyer, the Company will hold the Thai Baht or cryptocurrency in the buyer’s account required for payment including transaction fees, taxes and any other related expenses until a successful match is executed according to the specific order type. Following a successful match, the payment amount will be settled, and the purchased digital asset will be credited to the buyer’s account.

Similarly, for sell orders, upon submission of sell orders, the digital assets in the seller’s account will be held. Following successful order matching, the digital assets will be debited from the seller’s account, and the seller receives Thai Baht or cryptocurrency in their account after deducting transaction fees, taxes, and any related expense.

The debits and credits of Thai Baht or cryptocurrency will be immediately recorded in the customers’ asset ledgers. For customers in Thai Baht, they will be maintained in the Company’s bank deposit account for the benefit of the customers. For digital assets, it will be maintained in digital wallet held by the Company or by a third-party digital asset custodian.

3.2 Procedures for real-time verification of customers outstanding balances.

When the buy and sell orders are matched, the Company will execute settlement and deliver the digital assets by immediately debiting or crediting the outstanding balance in customer accounts at the moment the transaction occurs. These updates are reflected immediately upon transaction completion. Buyers and Sellers can asset balances immediately upon trade execution through the Company’s website and application.

4.Types and definitions of each trade order

- Market Orders – A market order is a buy or sell order executed at the best available price, which is the lowest ask price for buy orders or the highest bid price for sell orders. If the order is partially filled or cannot be fully executed, the system will automatically cancel the unfilled order. This cancellation occurs in situations such as there are no remaining buy or sell orders in the market, or there is insufficient buy or sell orders to fulfill the order.

- Limit Orders – A limit order is a conditional order to buy at or below a specified point, or to sell at or above a specified price. If the order is partially executed, the order remains active or open until fully executed or cancelled by the user. In the event of the scheduled system maintenance, the Company may cancel orders with prior notification to customers.

- Stop Orders – A stop order is a buy or sell order that allows customers to specify a trigger price for profit-taking or stop-loss. Upon the price reaching the trigger point, the system will automatically send a buy or sell market order into the market. Stop orders can be categorized into 2 types as follows:

1. Stop Market Order: a market order to be placed to the trading system as soon as the price moves up or down to reach the triggered price level.

2. Stop Limit Order: a limit order to be placed to the trading system as soon as the price moves up or down to reach the triggered price level.

- Trailing Market Orders – A trailing market order is a dynamic order with a trigger price that adjusts in real-time. Upon the price reaching the defined trigger price, a market order will automatically be sent to the system. This order type is suitable for maximizing potentials profit as long as the price moves in a favorable direction (Let Profit Run). Trailing orders can be categorized into 2 types as follows:

- Trailing Stop Market Order: an automatic market order to be placed to the trading system as soon as the price reverses and reaches the predefined price difference (Trigger Price).

- Trailing Stop Limit Order: an automatic limit order to be placed to the trading system when the price reached the defined triggered price system as soon as the price reverses and reaches the predetermined price difference (Trigger Price).

5.Trading hours and trading halts

Customers can trade on the exchange platform 24 hours a day. However, the Company reserves the right to close the trading system, cancel all outstanding buy and sell orders, or halt trading for specific assets or the entire market. Such actions are determined by the technology department’s considerations. Trading system halts may be categorized into the following 3 cases:

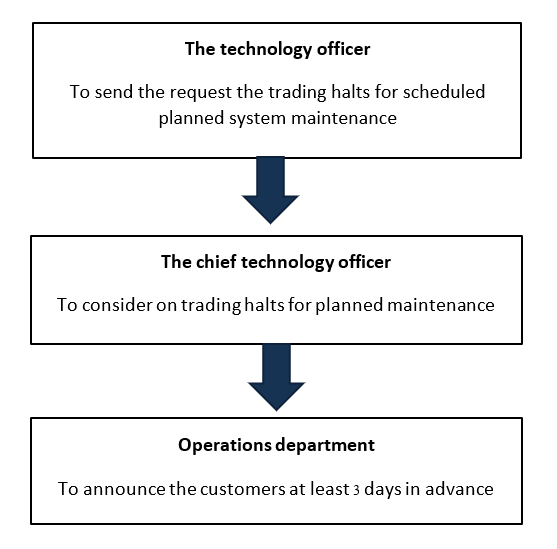

5.1 Trading halts for planned maintenance or system maintenance as follows:

- Scheduled or planned system maintenance

- Trading system upgrade

In the event of planned system maintenance or system upgrade, the Chief Technology Officer will inform the Director of Business Operations to notify customers at least 3 days in advance via the Company’s website, application and customers’ registered email.

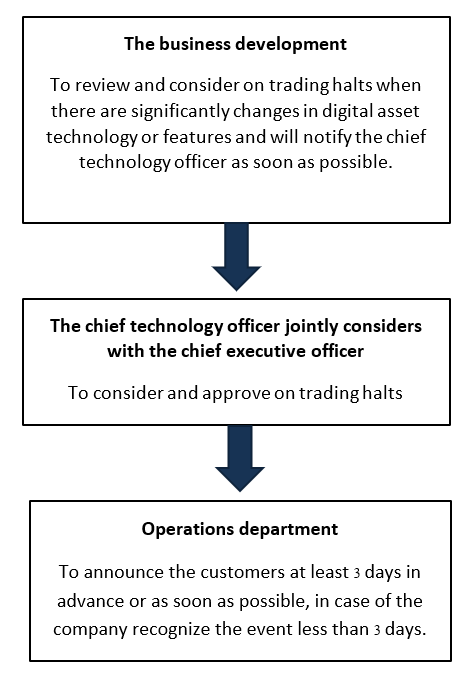

5.2 Trading halts when there is change in technology or digital assets’ feature as follows:

- There is a change in digital asset technology or digital asset’s features such as changing in protocol or chain migrations or if a digital asset becomes a privacy coin. The Company will consider delisting according to the Company’s delisting rules.

In the event of scheduled trading halts due to changes in the digital asset technology or features, the business development team will assess the trading halt and promptly inform the Chief Technology Officer. The Chief Technology Officer will inform the Director of Business Operations to notify customers at least 3 days in advance via the Company’s website, application and customers’ registered email.

In the event of unexpected changes in digital asset technology or features that prevent the Company from providing customers with at least 3 days in advance notice, the Company will promptly halt trading upon becoming aware of the event. Customers will be notified as soon as possible via the Company’s website, application, and registered email.

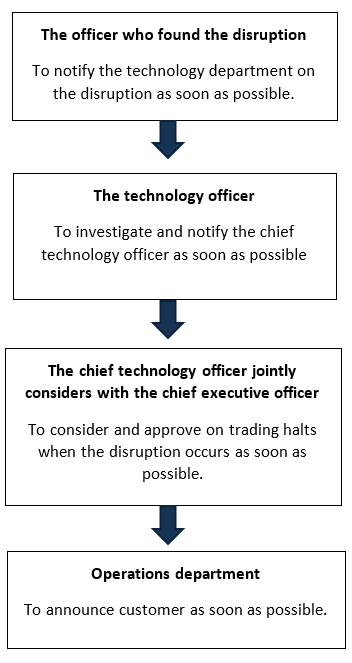

5.3 Trading halts when the system disruption or malfunction

- The disruption during the submission of buy or sell orders or matching such orders.

- In the event of the disruption in communication network related to the trading system, such as cloud server internet outages.

- Force majeure events impacting digital asset trading or beyond the Company’s control such as fires, riots, protests or wars.

- Any actions by government or regulatory entities, mandated by law, that may impact digital asset trading or normal Company operations.

- Other comparable events affecting the trading system, including significant digital asset events causing price impact or high volatility, may result in trading halts to protect customers assets. The Chief Technology Officer and Chief Executive Officer will jointly consider these halts.

In the event of trading halt due to system malfunction, the Chief Technology Officer and the Chief Executive Officer will jointly consider the halts. Following the decision, the Chief Technical officer will inform the Director of Business Operations to notify customers via the Company’s website, application and customers registered email as soon as possible.

6.Guidelines for marking the digital token and cryptocurrency

The Company will mark the digital asset when the following events occur and will mark until those events cease.

6.1 When a change affects investors' rights or an amendment is made to the information disclosure statement, prospectus, or whitepaper issued by a digital token issuer, as outlined in sections 1 or 2 of appendix 3 of the Securities and Exchange Commission (SEC) Notification Kor Thor. 19/2561. The notification pertains to the disclosure of information related to digital assets offered for trading on the digital asset exchange, the defining of the listing and delisting rules of digital asset offered for trading on the digital asset exchange and the disclosure of other information related to the digital asset offered on the digital asset exchange. In accordance with the SEC notification Kor. Thor. 19/2561, regarding the rules, conditions and methods for conducting the digital asset business, on 3 July 2018, and its amendments. The business development department will review the situation and notify the technology department to apply the N tag (Notice) at the relevant digital asset on the website and application, a 48-hour cooldown will commence, or until the issue is solved. The technology department will manually mark the specified digital asset, and the Company will disclose this information on the Company’s website.

6.2 When there is suspicion from trading activities, certain traders may possess material non-public information.

The operations department will review the trading patterns, the chief executive officer will consider whether the traders have access to such information and will notify the operations department. The operations officer will notify the technology department to apply the MN tag (material non-public information) at the relevant digital asset on the website and application, a 48-hour cooldown will commence, or until the issue is solved. The technology department will manually mark the specified digital asset.

6.3 When the trading price of digital asset changes by 30% or more, compared to its trading price on the Company’s trading system within the previous 24-hour period.

The Company will immediately notify traders with a 'P30' tag through an automated system. The system will remove the mark once it verifies that the trading price of the digital asset no longer changes by 30% or more within the previous 24-hour period and no longer meets the conditions for the tag.

6.4 In the event of any other situations that may significantly impact digital asset trading on the Company's digital asset exchange.

The business development department will review and notify the technology department to apply a C tag (Caution) to the relevant digital asset on the website and application. A 48-hour cooldown period will commence, or until the issue is resolved. The technology department will manually remove the tag, and the Company will disclose this information on the website.

7.Channels for disclosing digital asset trading rules to customers

Customers can access trading rules and other related information through the Company's website.